An Ultimatum to Unfairness: Best Practice IR Means Compete to Win

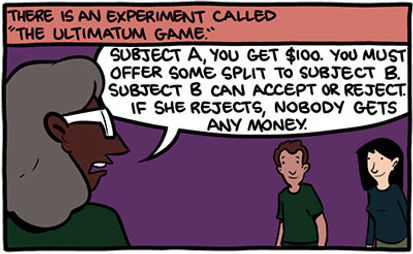

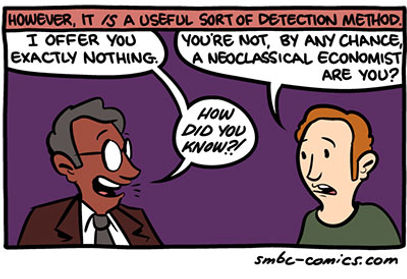

In the Ultimatum Game two people have to agree on the division of a sum of money in one try. One player proposes how to divide the amount. The other can accept or reject the offer, but both players get nothing unless the “receiving” player accepts the “proposer’s” first offer. Let’s say there is $100 involved. How would you determine the amount you would offer as proposer? More than likely you would - among other considerations - refer to your own concept of fairness in determining a sum. How much would you accept as the receiver, and how much would your own views on fairness factor into your decision tree? A “rational” receiver would in theory accept any sum, because they would be better off than they were before the interaction with little or no effort. But if as the receiver you thought of any amount above $1 that you would accept, you are demonstrating the fallacy of a totally rational/efficient capital market made up of individuals making nuanced decisions. But if you’re an IRO, you know that already of course.

The Dictator Game, one of the many variants of academic research and game theory discussions based on the Ultimatum Game, is where the giver alone decides the amount the other player should receive. Interestingly, even in that situation “the dictator” often relies on fairness to determine what to give away when it would seem rationally self-interested to give away the smallest amount possible. To transform the Ultimatum Game into a construct that better reflects IR let’s imagine both the proposer and receiver representing many people that depend on them for their livelihood and income. For both parties, the game comprises many transactions that affect the wellbeing of the people they represent - they are eliminated by breaking the rules, but they are ethically committed to compete, in terms of giving away the least or getting the most, for those they represent. For both managements and asset managers being fair is the basis of fiduciary duty and much of their fiduciary duty is comprised of competing in earnest. IROs are not referees in the “Competition for Capital” game, they represent the interests of management and current owners of the company’s stock. If anything, they are the capital markets coach for their team that is led by their senior management.

Being Fair to Fairness

Fairness must reflect in any effort to understand value exchange whether viewed from the perspective of macroeconomics or individual transactions, but it is part of the puzzle, not the full picture. Economics deserves to be called “the dismal science” as long as it remains in the ivory tower of pretending we can predict collective human behaviors without factoring in, well, their behaviors. Transactions involving decisions include fairness to some extent, but no two views of fair are the same in perspective or focus. Economics today addresses fairness by incorporating the behavioral sciences, and scientists and academics are conducting research and writing and reporting on what IROs live every day. Some of the books and their economist authors have become well known, and a great deal of the content is fun and fascinating to read - and essential to conducting real “Best Practice IR” - but managements and IROs are ignoring this goldmine of actionable “brains and behaviors” science. There are a variety of reasons they overlook the easy wins available to them by applying e.g. Nobel Prize winning knowledge to their capital markets campaigns, but they all stem from the fact that major influencers do not hold them to rigorous standards when it comes to deriving economic benefit from investor engagement. This is likely to continue so long as the “official” definitions of best practice investor relations rely on fairness, with the idea “fair” holds them to standards of not being criticized as opposed to the idea of accountability for achieving clear capital markets goals. Real Best Practice IR is about competing for capital, fairly, but also fiercely.

“OK Team, This is a Big Game, So Get Out There on The Field Now, and Play Fairly!”

Try to find “competing for capital” - or any concept of keeping score towards winning - in the definitions of best practice IR according to the world’s two leading professional organizations for IROs:

National Investor Relations Institute (US)

Best Practice IR is “…a strategic management responsibility that integrates finance, communication, marketing and securities law compliance to enable the most effective two-way communication between a company, the financial community, and other constituencies, which ultimately contributes to a company's securities achieving fair valuation.”

Investor Relations Society (UK)

Best Practice IR is “…the communication of information and insight between a company and the investment community. This process enables a full appreciation of the company’s business activities, strategy and prospects and allows the market to make an informed judgement about the fair value and appropriate ownership of a company.”

Real Best Practice IR is about achieving goals in the competition for capital. Rewards are inherent to inspiring the hard work and discipline needed to achieve meaningful goals. A harsh reading of the above definitions would identify “ultimately contributes to … achieving fair valuation,” or “allows informed judgment about the fair value and appropriate ownership of a company” as bureaucratic motivations, not goals. IRO’s are in a position to lead and should be motivated and rewarded as such. Try to imagine a leader with no goals, or a coach sending a team onto the field for the big game with the final exhortation above. The UK’s IRS once again comes out well ahead of NIRI by at least sneaking in the phrase “full appreciation of the company’s business activities” which in optimistic moments I imagine is British understatement for “achieve and maintain maximum capital markets valuation.” That is the most important goal of Best Practice IR and the economic and strategic benefits of investor relations are based on working to achieve it.

Most IROs Still Play “The Gentleman’s Game” but …

A focus on fairness is critical to building both “trust” and “credibility,” which have real value and tactical priority in IR planning and communications (especially when management has missed expectations), but trust and credibility are tactical goals that can and should be measured and analyzed over time just like any other business initiative or brand building exercise. That investor relations has escaped the rigors of real competitive analysis has to do with many factors ranging from Boards that remain in the thrall of transaction- and short term-driven advisors and interlocutors (and even shareholders), to the relatively rapid expansion of companies’ investor marketplaces. Most of today’s major global equity markets, London, Tokyo, etc., were not that long ago close-knit communities populated almost entirely by male decision makers with often longstanding personal and institutional relationships governed by gentlemen’s agreements. It was also not that long ago that the massive US capital markets were regionally driven except at the top tier of companies, which moved in their own tight circles of leading analysts and investors. With businesses and shareholder bases becoming more global and diverse, investor relations today remains rooted in the fundamentals of a “Gentleman’s Game” (painfully ironic since Investor Relations may have been the first financial and strategic leadership role where women routinely led major capital markets initiatives).

… The Best IROs Play “The Competition for Capital.”

Reading and learning about advances in behavioral and neurological science can give an unfair advantage (sorry, can’t stop) to the IRO, and in my next blog I will list my top ten books on the subject, highlighting their components that are directly relevant to Best Practice IR. In the meantime, if you have any suggestions, I would appreciate hearing them.